What Are SaaS Distribution Channels?

In SaaS, distribution channels refer to who sells the product to the customer and what method they use. There are a few commonly used SaaS distribution channels, including inbound and outbound sales forces, eCommerce self-service, and third-party app stores.

Choosing the right distribution channel to use in a particular stage of a company’s lifespan is a major strategic decision for a CEO. Specifically, it has numerous implications for the company’s economic model, the composition of its new hires, and the pricing necessary to be compatible with a particular channel. Typically, new startups begin with a single sales channel and will, over time, adopt more.

How Is SaaS Software Distributed?

There are multiple distribution channels for software products, including SaaS offerings. They can be broken down into two categories:

A. Direct Distribution Channels

B. Indirect Distribution Channels

First, let’s look at the definition of each category. Then, we’ll get into the specific options within each.

Direct distribution channels involve a SaaS company’s own employees, staff, and technical assets. They contact and sell to the customer. For example, let’s say you run XYZ SaaS Company and you sell to customers via a direct sales channel. Your customers’ invoices, contracts, or credit card statements will show “XYZ SaaS Company” as the merchant of record.

Alternatively, indirect distribution channels refer to SaaS companies selling through a third party. These can include resellers, app stores, and other partners. For a true indirect channel (as opposed to a hybrid or partially indirect channel), the merchant of record is not your company. Instead, it is a third party’s name that appears on the customer’s credit card statement, contract, or invoice.

It is not unusual for a SaaS company to rely on more than one sales channel. This is especially true when a company services a wide range of customers, from individual consumers to Fortune 500 companies. Also, it tends to occur as a company gets bigger and runs into points of diminishing returns in a single channel.

A. Direct Distribution Channels for SaaS Companies

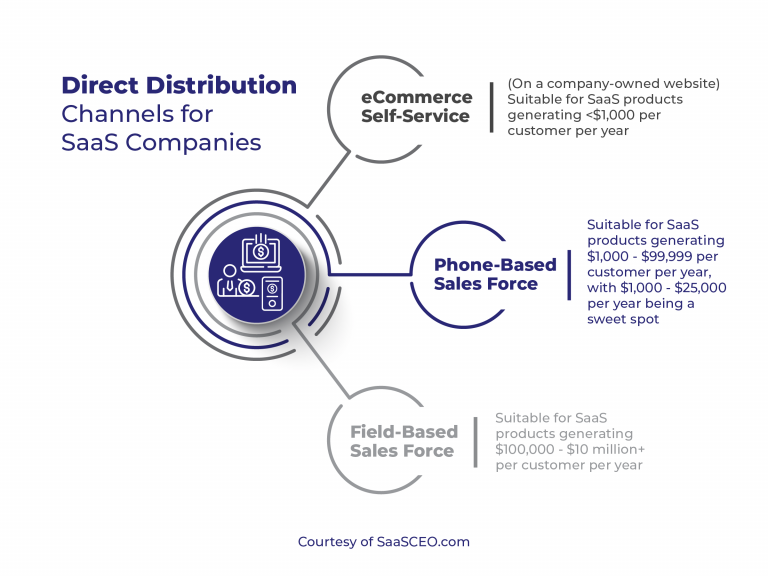

The price point or annual contract value (ACV) of a SaaS offering will often dictate which channels are economically viable. For instance, technology-automated distribution channels typically have a lower operating cost per sale than those channels that involve highly paid salespeople who visit prospects in person. These direct distribution channels listed in order of least to most expensive to operate include:

- eCommerce Self-Service (on a Company-Owned Website) (suitable for SaaS products generating <$1,000 per customer per year)

- Phone-Based Sales Force (suitable for SaaS products generating $1,000 to $99,999 per customer per year, with $1,000 to $25,000 per year being the sweet spot)

- Field-Based Sales Force (suitable for SaaS products generating $100,000 to $10 million+ per customer per year)

Because the operating costs of these channels will vary considerably, different direct distribution channels are better suited for certain types of customers and price points over others.

1. eCommerce Self-Service (on a Company-Owned Website)

One commonly used direct sales channel for SaaS companies is a company-owned eCommerce website. This approach relies on online marketing and an eCommerce website to source, sell, and fulfill purchases. Usually, this channel is more common amongst SaaS offerings with lower pricing.

This is a common channel for consumer SaaS applications and for SaaS offerings geared toward small and midsize businesses (SMBs). A company that relies on eCommerce as a channel requires ample online marketing skills. Marketers in this kind of company need to generate leads online. Additionally, they must manage the conversion process from prospect to sold customer entirely online. Typically, they do this without ever talking to a customer directly (other than a limited sample for research purposes).

Here are several companies that sell SaaS offerings via online self-service/eCommerce:

- Microsoft Office (Cloud Version) — in particular, for personal, family, and small business use

- QuickBooks Online — accounting software for small businesses

- Dropbox — online data storage

- Zoom — Videoconferencing

- Mailchimp — Email sending service

- SurveyMonkey — Online survey software

While eCommerce focuses on the company-owned website, the company can extend beyond its website to attract potential customers to its website. There are a few ways a company can accomplish this:

- Paid Social Ads

- Paid Search Ads

i. Paid Social Ads

With the rise of social media, eCommerce can effectively use various platforms such as Facebook, Instagram, and Twitter to promote the service. This can be accomplished through paid ads that target a specific audience who would be interested in the product. Paid ads can reach an extensive number of people and generate awareness, which can lead to additional revenue for the company.

ii. Paid Search Ads

SEO (search engine optimization) has changed how companies can advertise their service. A company can either research or work with a marketing agency to find popular search terms, then create ads that will attract people to its website based on popular keywords. Once the customer navigates to the website, the company then can rely on eCommerce to carry out the sale.

On average, the sales cycle for eCommerce-based sales can run anywhere from a few days to a few weeks.

2. Phone-Based Sales Force

Another very common sales channel in SaaS businesses is the telephone-based (or videoconferencing) sales force. A phone-based sales force doesn’t meet with customers face-to-face. They do not travel. Instead, the salesperson works either in the office or from home. They communicate with customers via various digital technologies — phone, videoconference, email, etc.

There are two sub-categories of phone-based sales forces. They are:

i. Inbound Phone Sales

ii. Outbound Phone Sales

i. Inbound Phone Sales

Inbound phone sales refer to customers who call in for more information regarding a company’s offerings. The principal role of the salesperson is to call customers back after the customer initiates contact in some way. For example, they may have requested a phone call, downloaded a white paper, attended a webinar, or requested a follow-up.

Typically, a marketing department with a “lead generation” or “demand generation” role generates these prospects. Then, the role of phone sales is to respond to the inbound inquiries generated by the marketing team. Primarily, inbound phone sales teams work with “warm” prospects. These are potential customers who already have some degree of awareness of the company, its offerings, or its expertise. The phone team’s role is to close the leads that marketing generates.

Tradeoffs of Inbound Phone Sales

Often, companies that rely on inbound phone sales have high marketing labor costs and advertising costs. The downside of relying on lead generation marketing and an inbound sales team is that cost-effective advertising options are limited. For instance, there are only so many people on Google searching for a specific keyword phrase. Similarly, there are only so many people on SaaS product review websites like Capterra.com and G2.com.

Many of these paid advertising sites work on bidding systems. In these cases, your ads can appear ahead of your competitors’ ads if you’re willing to pay more. However, as an advertising medium matures and becomes more crowded, the cost to get a click from a paid ad increases as a result. At some point, it’s no longer economically worth it. This leads us to our next type of phone-based sales force.

Lead generation marketing and inbound sales work well for prospects who are aware they have a problem, are gathering information to better understand the problem they have, and often are actively looking for a solution. I refer to this kind of prospect as “active demand” as they are “actively” looking for information or to buy a solution. Typically, less than 5% of the individuals or businesses in a market are actively looking for a solution.

For example, there are approximately 275 million registered vehicles in the United States. By law, all of them must be insured to legally drive on the road. In any given year, only a small percentage of car owners are actively looking for insurance. Those who are looking are considered active demand. The rule of thumb is that, in any given market, only 5% of the market is actively looking for a solution at any given time.

ii. Outbound Phone Sales

An outbound phone sales distribution channel is one where the sales team reaches out to initiate first contact with a prospect. In short, outbound phone sales teams perform “cold calls” and other outreach methods (such as emails or LinkedIn direct messages) to make first contact with a prospect. Since the salesperson is the one to reach out, the function is aptly named “outbound” sales.

With this distribution channel, the outbound sales team is responsible for: 1) Generating the lead; and 2) Closing the sale (as opposed to the inbound sales model where the marketing team generates the lead, and the inbound team is only responsible for closing the sale).

Typically, the outbound sales team is broken up into two roles. First, there’s the sales development representative (SDR) or business development representative (BDR). They are responsible for making cold calls, generating leads in the form of scheduled sales appointments. Then, the SDR/BDR typically passes that lead off to an account executive (AE) who is responsible for closing the sale.

In this way, the SDR/BDR performs an analogous function as the lead generation or the demand generation team within the marketing department that is paired with an inbound sales team.

Primarily, the benefit of an outbound sales team is greater market reach. With inbound sales, you’re largely limited to only the active buyers in a market. With outbound, you can reach people who have the underlying need for your products but are not actively searching for a solution at the moment. This is known as “latent demand,” and 95% of the market falls in this category.

Usually, the sales cycle for phone sales can run anywhere from a few weeks to a few months.

3. Field-Based Sales Force

The final SaaS direct distribution channel is a field-based sales force. Typically, these are very highly paid sales professionals accustomed to selling six-, seven-, or eight-figure deals with senior executives in Fortune 500 companies. As contract values get into the six and seven+ figures, salespeople often make those sales face-to-face. Ultimately, deals of those sizes are as much about the relationship between the buyer and the salesperson as they are about the product. It’s easier to establish and build relationships face-to-face.

Because of the compensation costs of a field-based sales force, you need your price point or annual contract value (ACV) to be over $100,000 — preferably significantly so.

Usually, sales cycles for deals of this size run anywhere from a month up to a few quarters.

B. Indirect Distribution Channels for SaaS Companies

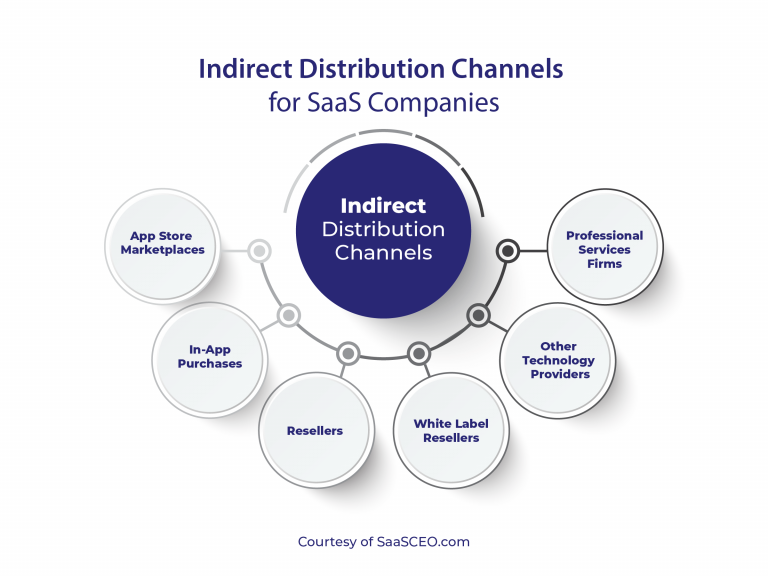

Indirect SaaS distribution channels involve third parties in the sales and transaction process. In a pure indirect channel situation, the relationship is between the customer and the intermediary. Here are several indirect distribution channel options:

- App Store Marketplaces

- In-App Purchases

- Resellers

- White Label Resellers

- Other Technology Providers

- Professional Services Firms

1. App Store Marketplaces

App stores from Apple, Google, Microsoft, and others allow SaaS and one-time sale app makers to sell their offerings through the marketplace of a much larger company. In this case, the advantage is that there’s enormous traffic in the marketplace from people who want to buy apps. These marketplaces offer both one-time sales and recurring subscription models. Thus, it’s easy to reach a larger global audience with no significant investment to get started.

At the same time, there are downsides to app store purchases. For one, there is a loss of strategic control. Additionally, there’s a significant revenue-sharing commitment to the app store market maker.

2. In-App Purchases

Related to the App Store indirect sales channel is the use of the app itself as the sales channel. While using the app, one may encounter advanced functionality that one can’t access without an upgraded subscription fee. In this case, the app itself becomes the salesperson.

When this takes place, the intermediary handles the billing. This would be considered a subset of the revenue stream from the app store channel. However, I list it here separately to draw greater attention to it.

3. Resellers

The oldest and best-established indirect sales channel is the reseller. Previously, when software was sold primarily on physical media, companies like Staples, Office Depot, and CompUSA bought software at wholesale prices and sold it to consumers and small business owners. The key traits of a reseller are that the intermediary buys at a discounted price and sells at a markup. Meanwhile, software companies traditionally don’t have any of the contact information of the end-user.

Additionally, an important distinction of the traditional reseller is that the customer is aware of the SaaS company’s brand name.

With software moving to the cloud, the reseller channel still exists. The best example is going to Amazon.com and buying Microsoft Office from Amazon. In this case, your credit card receipt lists Amazon as the merchant of record. When you download Microsoft Office, you do so while logged into your Amazon account. As such, the purchase is an annual recurring subscription between you (the user) and Amazon.

When you download Microsoft Office, as of this writing, you’re actually downloading an installer for the desktop version. You also get online access to Microsoft Office in the cloud.

Essentially, when you buy Microsoft Office through Amazon acting as a reseller, you’re still aware of the Microsoft brand name. You’re aware you’re using Microsoft Office.

4. White Label Resellers

A white label reseller is an intermediary that also resells your offering. However, as a condition of the partnership agreement, the identity of the SaaS company is hidden or obscured. Originally, the term white label came from the grocery industry and canned goods. You can buy name-brand canned beans from Del Monte, or you can buy the store brand. In some cases, the actual food may come from the same originating farms… with a store-branded “white label” placed on the unlabeled can.

This idea has also carried over into software. In a pure white label relationship, the technology is resold, unmodified, without your SaaS company’s branding. Instead, the reseller uses its branding.

Pure white label reselling is less common these days in SaaS (though very common in physical goods). In the past, it made sense when the reseller had a very strong brand name and customer relationship, while the “manufacturer” was unknown. The reasoning was that the customers trusted the reseller’s name a lot more than some no-name manufacturer.

For example, let’s say a U.S.-based SaaS company has opted to expand internationally through a white label reseller partnership. The SaaS company has no brand recognition in the international country and no desire to add employees in that market. However, it has found a well-established, well-known player in that market to partner with. Now, the partner may resell the product in their country and provide sales and support in the local language.

5. Other Technology Providers (That Embed Your Offering Within Their Technology Offering)/Original Equipment Manufacturer (OEM) Type of Partner

Another indirect sales channel involves partnering with other technology providers. These technology providers embed your SaaS technology within theirs, behind the scenes. Then, they sell the combined bundle to customers under their own brand name. SaaS companies who chose this route are often referred to as original equipment manufacturers (OEMs). In these cases, the customer and end-user only perceive a relationship with the other technology provider. Typically, the user has no idea your SaaS company is involved.

This relationship is slightly different from a white label reseller relationship. Essentially, the key difference is that your SaaS technology is resold with modifications. Usually, these modifications involve integrations between the other provider’s technology and yours.

For example, there may be a SaaS offering that gives small businesses the ability to send emails or SMS messages to customers. In this case, the end-user may not be aware that, behind the scenes, there’s another SaaS company involved, providing email delivery and SMS message delivery services (that some would characterize as an “infrastructure as a service,” or IaaS).

6. Professional Services Firms (That Embed Your Offering Within Their People-Delivered Services)

The final type of indirect channel would be partnering with a professional services firm. In this scenario, the customer pays for a professional services contract with the services firm. In turn, the people-oriented services firm buys SaaS licenses from your company in order to use your technology to serve their client. For example, let’s say you provide a human resources management SaaS product. You might partner with a human resources consulting firm. The consulting firm buys your technology in bulk to wrap into their professional services with clients.

In this case, the offering the customer buys is a “managed services” offering. They pay for people (from the services firm) and technology (from your SaaS company). In this example, the services firm is sometimes also called a “technology-enabled service provider.”

There’s an old adage that in order for a technology project to succeed, you need three things: 1) People; 2) Process; and 3) Technology. When you’re adopting an indirect SaaS distribution channel, you’re partnering with someone else who provides the people and process while you provide the technology.

Which Distribution Channel Is Best for a SaaS Company?

There is no distribution channel that’s ideal for all SaaS companies under all conditions. Rather than thinking about the best distribution channel, it’s more useful to think of distribution channel selection as a “best fit” decision. Which distribution channel best fits our situation?

Two things drive this decision:

- Economics

- Strategy

Economics

The price and the pricing model of your product will drive how you promote it. It’s not a “one size fits all” approach to selling every product. Think about how you are planning on selling your product – whether that’s through a subscription model or a one-time purchase model.

If you sell a mobile app on a $10 per year subscription fee, you simply cannot afford quota-carrying sales reps traveling in the field and meeting with prospects.

Similarly, if your SaaS offering requires a lot of technical integrations before a Fortune 500 customer can use it, and your minimum annual contract value is $1 million a year, there’s no way you’re selling that via eCommerce and asking customers to click their shopping cart and check out.

Strategy

Do you want to use the distribution channel everyone else is using because you know it works? If so, that’s certainly one valid line of reasoning, and it’s often useful.

Alternatively, do you want to zig when everyone else zags and use a distribution channel that others do not?

For example, a classic tradeoff with distribution channels is when a company has both direct and indirect channels. Your partners don’t always like competing with your salespeople. This is known as channel conflict. It’s an issue.

In some businesses, one valid distribution strategy is to only focus on indirect sales channels and working with partners. The partnership presentation goes something like this: “We are the only partner-friendly company in the space. We have no direct sales force. We only prosper by helping you prosper. Why would you want to give money to a company that’s trying to compete with you via their direct sales force?” That’s a valid option.

Another option would be to target the low end of the market. Go with a low-price, highly automated, self-service, eCommerce-based approach to distribution. Conversely, you could go the opposite route. You focus on the higher end of the market, provide a feature-rich offering, and price it two to three times the price of the competitor. You also assign a salesperson, an account manager, and a customer success representative to new accounts. In this case, your offered solution is reassuringly more expensive and worthy of someone betting their career on you.

Additional Resources

If you enjoyed this article, I recommend joining my email newsletter. You’ll be notified when I publish other articles and helpful guides for improving your SaaS business. Submit the form below to sign up. Also, use the email icon below to share this article with someone else who might find it useful.

If you’re the founder and CEO of a SaaS company looking for help in developing a distribution channel strategy, please Click Here for more info.

How to Scale and Grow a SaaS Business

Pingback: How Is SaaS Software Distributed?

Wonderful article! Came across this page while searching for distribution channels for software. Our SaaS product is called Cart2Order and we are definitely going to use some of the tips provided in this article. Thanks!