In this article, I’ll define net revenue retention, show you how to calculate it, explain why it’s important, and show you how to use it to manage your SaaS company.

What Is Net Revenue Retention in SaaS?

Net revenue retention (NRR) is a key performance indicator that measures the combination of two things:

- How well you retain your customers (by preventing them from churning or canceling their subscriptions)

- How well you upsell your existing customers (and generate incremental revenue from existing accounts)

The “revenue retention” part of net revenue retention refers to the amount of revenue you collected from accounts at the start of a month compared with the revenue collected the following month from the same accounts. Any accounts added during the month are excluded from the calculation.

For example, if you have 100 accounts that pay you $1 on the first day of January, you have $100 in revenue for January. In February, if all 100 accounts decided to stay subscribed and again paid $1, you have 100% revenue retention for February.

The “net” part of net revenue retention refers to an increase in revenue from existing accounts during the month.

For example, let’s say you have 100 accounts that paid you $1 in June. You have $100 in revenue in June from those accounts. In July, you still had those 100 accounts. However, because you worked on a cross-selling/upselling sales effort, you got those 100 accounts to pay you an average of $1.10. You have $110 in revenue in July from those 100 accounts that you inherited from June. In this scenario, your net revenue retention is 110% (The Math: $110 in revenue in July / $100 in revenue in June).

Note: Net revenue retention is typically calculated on either a monthly or annual basis. Both approaches are correct so long as you disclose the time period utilized. If used in a monthly context, label your dashboard “Monthly NRR.” If you cite these metrics in a board of directors document, you might cite “Annual Net Revenue Retention.”

How Do You Calculate Net Retention?

Net revenue retention is calculated as follows: For a particular cohort of customers (such as all customers who were actively paying in January 2021), you take their January 2022 revenues and divide them by their January 2021 revenues. The answer is then expressed as a percentage.

The key is to intentionally exclude customers you acquired from February through December of 2021. The idea is to see how much revenue you retained from that cohort of customers a year later and how much more you sold to those same accounts.

Net revenue retention rates over 100% are excellent, as this indicates that your company can grow perpetually without ever acquiring a new customer.

For help calculating net retention, Click Here to Download my Net Revenue Template.

What Is Good Net Retention?

For a B2B SaaS company focusing on Fortune 500 companies, a good gross retention rate is 98% per year, and a good net retention rate is 110%+ per year.

If the B2B SaaS company focuses on small business customers, a good gross retention rate is 80% per year, and a good net retention rate is 90%+ per year.

Why Is NRR Important?

Net revenue retention is the single best leading indicator of whether a SaaS company’s revenue will skyrocket or hit a ceiling.

Here’s why.

The SaaS and other recurring revenue businesses are highly sensitive to churn. If customers subscribe and then churn out, your business revenues automatically shrink over time.

However, if your net revenue retention is in excess of 100% (which is stellar), that means that even if you don’t add any new customers, your revenues will, in theory, keep on growing forever. Mathematically, the revenue ceiling for your SaaS business is infinite.

This is why SaaS companies with high net revenue retention rates (indicating existing customers don’t leave and also increase their spending each month) and high new customer acquisition rates (who subsequently become existing customers the following month) will often get sky-high valuations. This is where “unicorn” SaaS companies with enterprise values over $1 billion come from.

Net Revenue Retention — Exponential Growth vs. Decay Chart

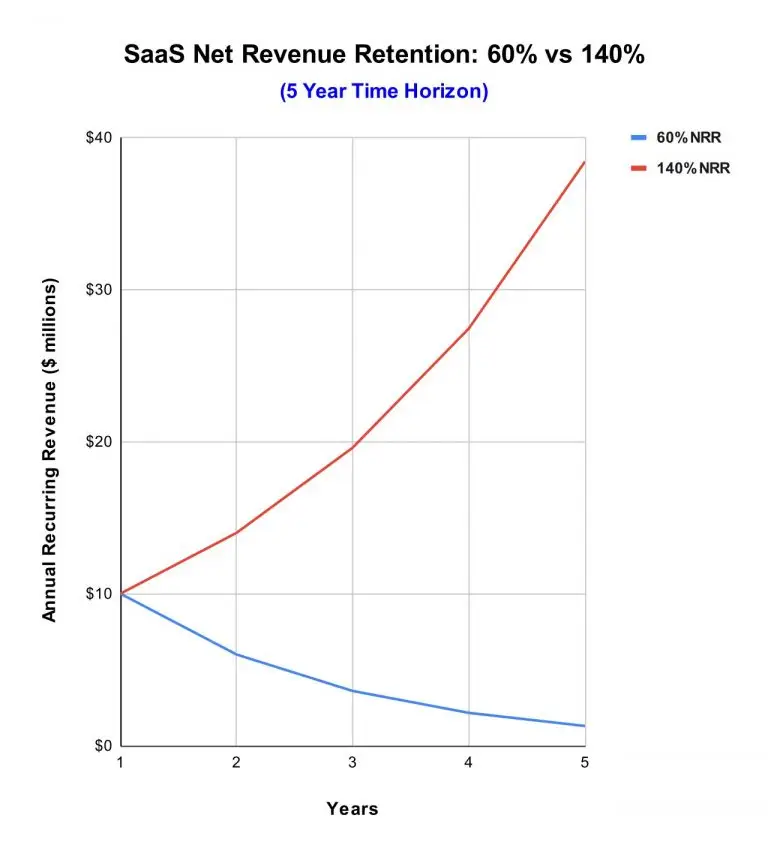

To appreciate this mathematical trait of high net revenue retention, let’s say your SaaS company has $10 million in annual recurring revenue (ARR). We’ll further assume that your company will not ever acquire any new customers again.

Let’s imagine what happens to your ARR under two different scenarios.

Scenario 1: 60% NRR

Scenario 2: 140% NRR

Intuitively, we know that higher net revenue retention is better. But how much better is it really?

In both scenarios, annual recurring revenues in year one are $10 million.

Guess what annual recurring revenues will look like in five years, ten years, and 15 years…

Let’s take a look:

At 60% NRR, your company drops from $10 million to $1 million in five years. In comparison, if you have 140% NRR, your company grows from $10 million to $38 million.

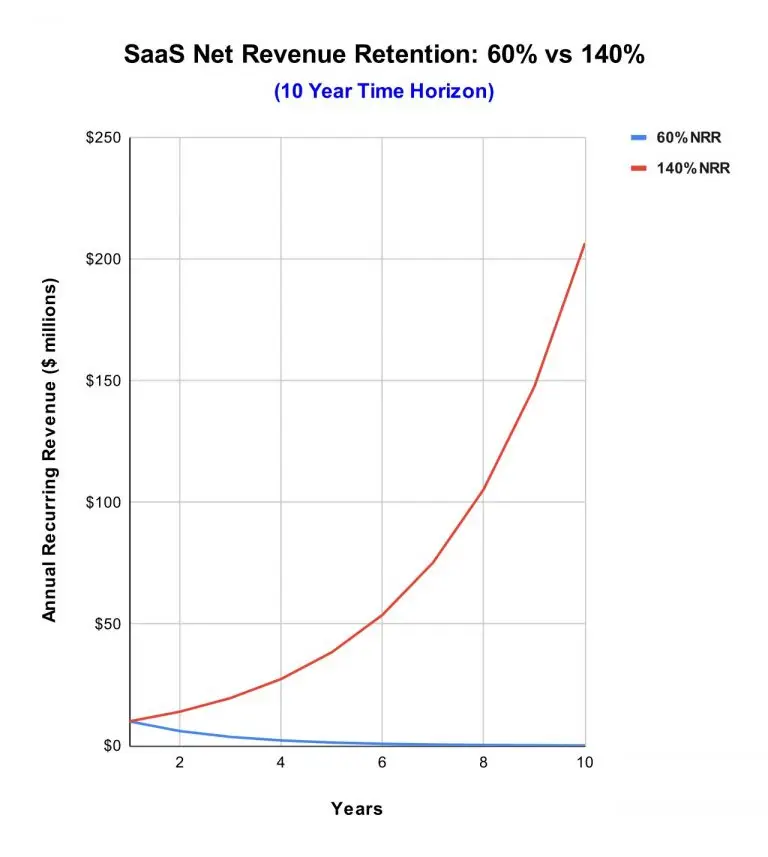

At 60% NRR, your company drops from $10 million to $100 thousand by the ten-year mark. In comparison, if you have 140% NRR, your company grows from $10 million to $207 million in ARR.

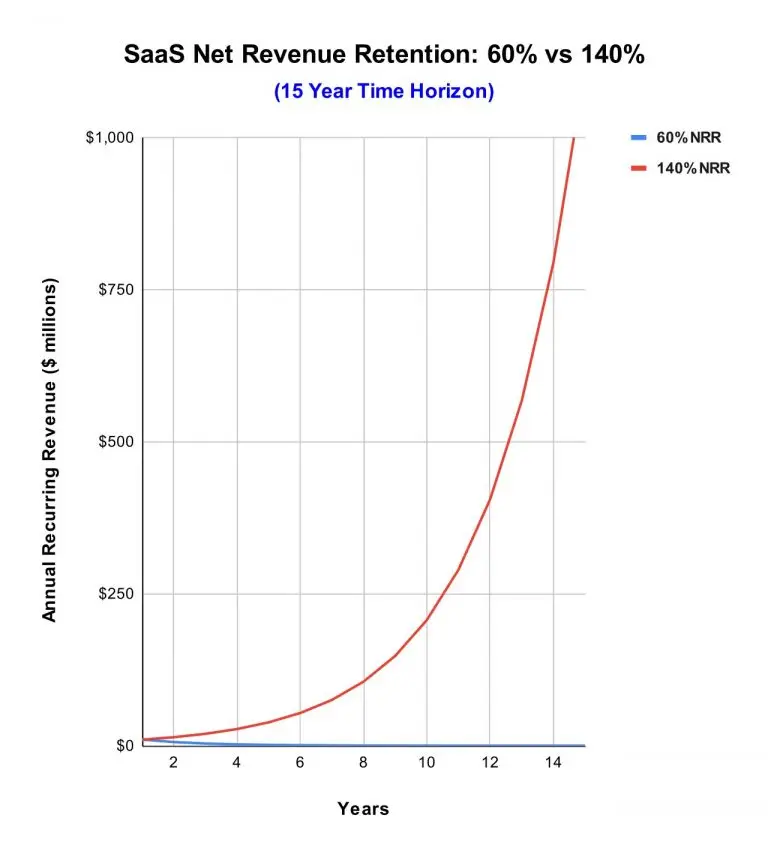

At 60% NRR, your company drops from $10 million to nearly $0 well before you hit the 15-year mark. In comparison, if you have 140% NRR, your company grows from $10 million to $1.1 billion in ARR.

Keep in mind that this is $1.1 billion in revenue assuming you acquire zero new customers over 15 years. Needless to say, the math is breathtaking.

This is why venture firms, private equity firms, and public shareholders value companies with high net revenue retention. Once your NRR is over 100%, the growth is meteoric even with zero new customer acquisition.

In essence, once your net revenue retention exceeds 100% and stays there, it is mathematically impossible for your annual recurring revenue to shrink.

Additional Resources

If you enjoyed this article, I recommend joining my email newsletter. You’ll be notified when I publish other articles and helpful guides for improving your SaaS business. Submit the form below to sign up. Also, use the email icon below to share this article with someone else who might find it useful.

If you’re the founder and CEO of a SaaS company looking for help in developing a distribution channel strategy, please Click Here for more info.

How to Scale and Grow a SaaS Business